By Greg Bishop/Illinois Radio Network

SPRINGFIELD – After more than two hours of heated, often emotionally charged debate, Illinois House Democrats on Sunday approved a tax increase in excess of $5 billion – the largest in state history – with some Republican support.

The final vote tally was 72-45 – with 15 Republicans joining the majority. Some Democrats also voted against it.

The increased tax dollars are intended to offset House Speaker Michael Madigan’s $36.5 billion spending plan that was approved minutes later by a vote of 81-34, with several more Republicans in support.

In the fiscal year that ended Friday, Illinois is expected to bring in between $31 billion and $32 billion in revenue. Madigan’s tax hike would fill the gap between last fiscal year’s revenue and this year’s proposed spending.

Both the tax increase and the spending measures now move to the Senate, which already has approved a tax increase and spending plan with no Republican support. If the measures are approved there, as expected, they will be sent to Gov. Bruce Rauner.

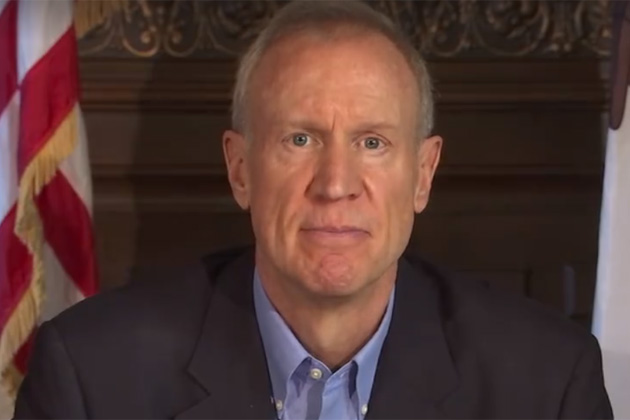

In a statement released shortly after the Sunday evening votes, Rauner said he would veto both measures.

“Under Speaker Madigan’s direction, legislators chose to double down on higher taxes while protecting the special interests and refusing to reform the status quo,” Rauner said. “It’s a repeat of the failed policies that created this financial crisis and caused jobs and taxpayers to flee. I will veto Mike Madigan’s permanent 32 percent tax hike.”

In his own statement, Madigan praised what he called a bipartisan effort.

“Today, Democrats and Republicans stood together to take a crucial step toward reaching a compromise that ends the budget crisis by passing a fully funded state budget in a bipartisan way,” the House Speaker said. “While none could say this was an easy decision, it was the right decision.”

Illinois has been without an approved budget for more than two years. Despite that, spending has been on autopilot because of court orders and consent decrees. As a result, Illinois has accumulated a backlog of unpaid bills totaling $15 billion. It’s unfunded pension liability has ballooned to more than $130 billion. And bond rating agencies have threatened to lower Illinois’ credit to junk status, which would be the first for a U.S. state in history and increase interest costs on borrowing.

Rauner and most Republicans have called for spending cuts and other reforms to reduce Illinois’ highest-in-the-nation local and state tax burden and reverse the flow of residents to other states. Illinois has lost population each of the past three years, more than any other U.S. state, with many blaming high taxes and stagnant job growth.

To turn the tide, Rauner has sought reforms to improve Illinois’ economy and reduce government costs. He’s called for a property tax freeze as well as pension, workers’ compensation and other reforms. Democrats have proposed their own reforms, but Republicans say they are watered down and won’t result in any true savings.

It was lack of progress on the reforms that led Madigan to push through the tax increases and spending plan without Rauner’s support.

“When I took office, I promised the taxpayers of Illinois that I would fight every day to take this state in a new direction after decades of failed leadership from both parties,” Rauner said. “Today, Springfield has decided to give the people of Illinois the largest tax hike in history and continue out of balance budgets with no real reform.”

Madigan’s income tax hike would bump the rate from 3.75 percent to 4.95 percent effective July 1. A family with household income of $60,000 a year would owe the state about an additional $720 each year. Their rates would increase from about $2,250 annually to about $2,970, depending on how many exemptions they claim. The corporate tax rate would increase from 5.25 percent to 7 percent, a 33 percent hike.

During debate on the House floor on the tax hike measure, lawmakers from both sides of the aisle made their cases.

House Deputy Majority Leader Lou Lang, D-Chicago, advocated for the tax increase just before the vote.

“Taxes are a necessary evil,” Lang said. “It takes courage to increase taxes.”

State Rep. David McSweeney, R-Barrington Hills, disagreed.

“Fifteen Republican House members waved the white flag of surrender to Speaker Michael J. Madigan and passed his massive tax increase,” McSweeny said. “What we need in this state is more jobs and more taxpayers. We need economic growth. We need policies that will create jobs.”

Rep. Michael Unes, a Republican who voted in favor of the tax increase, said it was among the toughest votes he had to make.

“Nobody should celebrate should this bill pass because we should have never gotten to this point to begin with,” Unes said. “It is shameful and embarrassing.”

Rep. Jeanne Ives, R-Wheaton, offered similar sentiments.

“This is the wrong plan at the wrong time,” Ives, said. “We need to fix our job creation first … Our economy is too weak for a tax hike … The only people who are going to gain from this are the public sector unions … They are the only ones who are going to gain in this tax increase, not the hard-working people who live down the street from me and our small businessmen.”

Rep. Steve Reick, R-Woodstock, said he was appalled by the lack of consideration for taxpayers.

“In the sixth months that I have been here, I have seen a fundamental unseriousness in this body toward how we spend other people’s money,” Reick said. “And until the day comes that we can find it within ourselves to stand up and just do the right thing with spending, I can’t support this bill.”