By Greg Bishop/Illinois Radio Network

WASHINGTON – The U.S. House will vote again on Wednesday after the approved tax reform bill in DC tripped on a procedure and Illinois’ congressional delegation is split on whether the nation’s tax code should be reformed.

The measure initially passed the House Tuesday afternoon mostly along party lines, 227-203. As the Senate began debating the measure, the Senate parliamentarian reported to the House to remove two provisions, the K-12 education savings benefit and a small college endowment credit, that didn’t comply with Senate rules. The House is in again Wednesday to vote on the corrected measure.

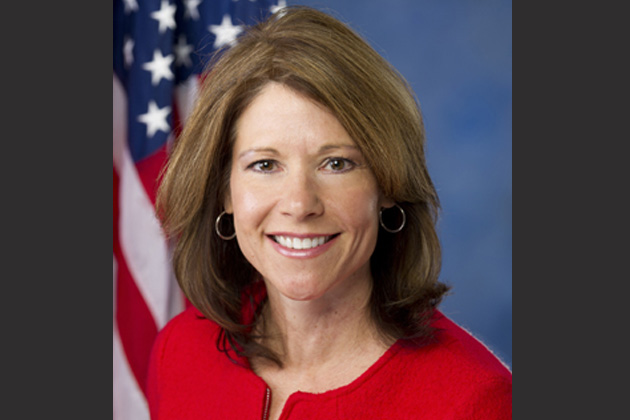

U.S. Rep Cheri Bustos, D-Moline, said during Tuesday debate that the GOP-crafted measure is a scam.

“Sure, this bill will create jobs,” Bustos said. “It will create them over in China and in Mexico and Malaysia.”

U.S. Rep. Peter Roskam, R-Wheaton, said the opposite is true.

“It offers tax relief that my constituents are longing for, and it offers a business environment in the milieu that makes things happen and happen for the good,” he said.

The measure would reduce the federal corporate tax rate from 35 to 21 percent and reduce rates for individuals across seven brackets.

PODCAST: Listen to Scott’s interview with U.S. Rep. Darin LaHood on WJBC.

The individual tax reductions expire after eight years. U.S. Rep. Rodney Davis, R-Taylorville, said he’s filing legislation to make the cuts permanent.

The plan would also double the child tax credit from $1,000 to $2,000 and double the standard deduction to $24,000 for a couple filing jointly.

House Minority Leader Nancy Pelosi, D-Calif., called the tax cuts theft. House Speaker Paul Ryan, R-Wis., said tax cuts mean people keep more of their own money.

Both of Illinois’ Democratic senators voted against the measure late Tuesday.

What does it mean to you in Illinois?

Oakbrook, Illinois, tax professional Michael Leonard of Leonard and Associates said there are some good things for Illinoisans, especially for businesses, big and small.

“It should make the small businesses be able to hire more and just keep more money in their pocket,” Leonard said. “It’s a very, very good thing because small business is what keeps the economy going.”

But he said the $10,000 cap on deductions for state and local taxes will hurt many Illinois taxpayers who pay some of the highest property taxes in the country. Leonard expects that to put pressure on state lawmakers to address the issue.

“They’ll have to do something,” Leonard said. “You can’t have all these high taxes and not have a break somewhere.”

Leonard said he worries doubling the standard deduction could mean fewer people give to charitable causes as a way to lower their tax liability.

The Illinois Farm Bureau is applauding the proposed federal tax reform saying it’s long overdue. IFB President Richard Guebert said its analysis shows farmer will pay a lower effective tax rate and they’ll be able to reinvest and grow their businesses. Guebert said the tax savings are important following a fifth consecutive year of declining net farm income.