By Dave Dahl

SPRINGFIELD – “Do we really need $5 billion in that (road) fund?”

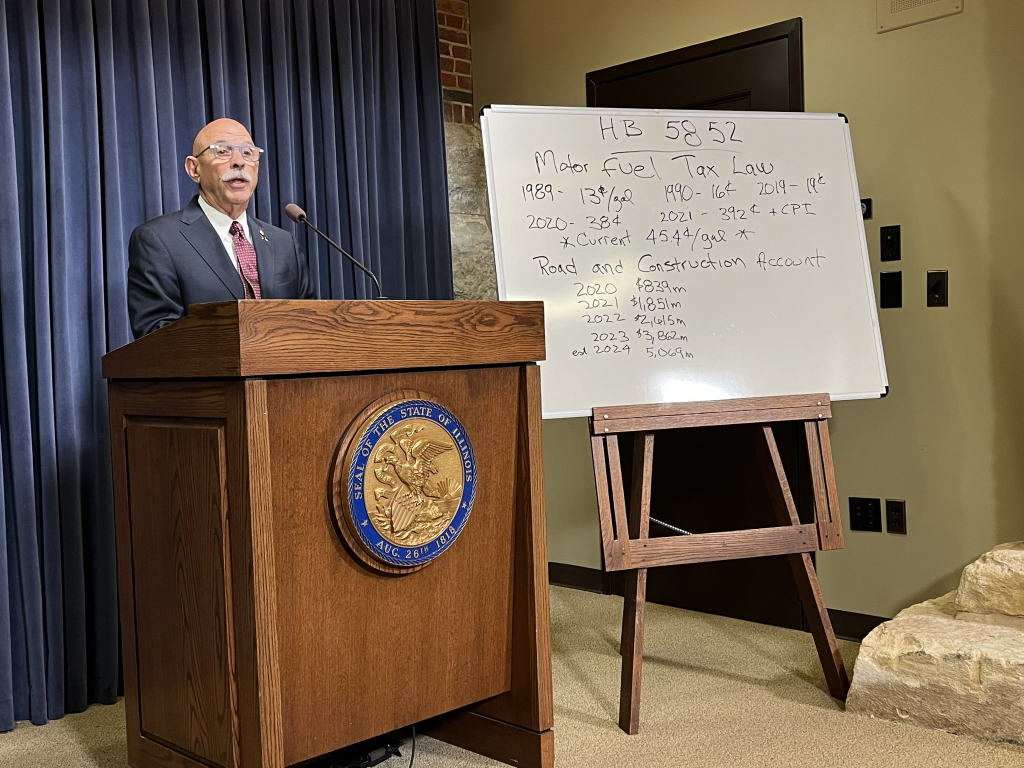

That’s the question State Rep. Dan Caulkins (R-Decatur) says one should ask when considering the state’s gas tax, currently tied to inflation. The state’s portion of the gas tax is now 45.4 cents per gallon.

He dislikes the provision in current law for an automatic increase – without the General Assembly having a say.

“We are spending a lot of money on roads and bridges,” Caulkins said at a statehouse news conference. “But look what’s happened to our fund! Our fund balance has gone from $839 million (in 2020) to what’s estimated this year to be over $5 billion. That’s $5 billion in taxes that are collected at the pump.

Caulkins’ idea is to freeze the tax for two years.

HB 5852

Dave Dahl can be reached at [email protected]